When disaster strikes, it’s natural to feel the urge to help but not know how. We toil on social media, sharing squares and circulating links and spiraling into an echo chamber of passive despair without accomplishing much of anything at all. This is no one’s fault—it’s just the way we project and how we consume these days. Yet, when you take a closer look at your own skillset, your own resources, your own knowledge, you might find that you’re able to make a difference by just offering what you have to offer.

This wasn’t what I planned to write about this week, but the tragic fires in Los Angeles are impacting thousands of families who now must navigate the most catastrophic event of their financial lives. Aside from donations and prayers, I can offer what I know.

This issue of The Joint Account offers insurance information to help homeowners before, during, and after disaster strikes.

For more than a decade, I held down various roles the commercial insurance industry, many of which involved claims handling and insurance coverage. I believe the insurance industry will see dramatic changes based on the severity and recurrence of natural disasters now and in the years to come. What that means for us, as policyholders, remains to be seen. For all the times I never thought I’d be able to really help people in my legal career the way I had intended, moments like these remind me how your impact isn’t limited to your formal responsibilities at any job. Over time, we build up a wealth of knowledge that we can choose to deploy in the places, and for the people, we want to. This newsletter (and our forthcoming book, tbh) give me the chance. Every day, we all have a new chance to use what we have for good.

If you’re thinking, man, didn’t she just write about insurance in October, then maybe today isn’t our day, and you can just bookmark this for future reference. Please know, my suggestions are not tailored specifically to California residents but are rather meant to help anyone, anywhere, anytime. As I scrambled to write this, I am just scratching the surface. Those currently in need of more thorough assistance should consult a local professional for the most up-to-date information on the developing crisis.

BEFORE

Understand your coverage. Homeowner’s insurance is not a blanket that drapes your home and everything in it with complete financial protection. I wish it was that simple. There are things you should understand about insuring damage or losses to your property, home structure, furnishings, and other personal items. Knowing exactly what you’re paying for puts you in a position to make proactive choices rather than be surprised when it’s too late.

You should become familiar with your:

Policy limits. This is the most money your policy will pay you if covered damages or losses occur. Some policies provide different limits for different events, but let’s leave it here.

Replacement cost v. actual cash value. Does your policy pay to replace the things that you’ve lost, or does it reimburse you for their actual cash value, which is a lesser amount that factors in depreciation? In the case of your home, policies usually offer limits up to the replacement cost. However, when there’s frantic demand to rebuild entire communities, construction costs will balloon—we saw it after Hurricane Sandy here on the East Coast. With certain insurers, you can purchase more coverage to account for the rising cost of labor and materials. It makes me ill to think of all the families who won’t have enough coverage—hell, the financial bargaining power—to have their homes rebuilt in California. I better keep going.

Covered and excluded perils. What event caused the damage or loss to your property? Only damage arising from some natural disasters, such as windstorms and hail, might be covered. Others, like floods, earthquakes, and fires, might be excluded.

Deductibles. Just like your health insurance plan, many of these policies also have deductibles, which are cash amounts you’re required to front before the insurer pays anything.

Additional Living Expenses (ALE). An ALE provision reimburses you for all the extra costs when you’re unable to live in your home due to a covered loss. Think hotel stays, food, gas, etc. I could go down a whole rabbit hole on this one but focus on how long and how much your policy will reimburse you for.

Any policy changes. Don’t just click “renew” at the end of every policy term. Your needs may change, and the policy could change. This renewal year, our health insurer quietly removed the limited overseas coverage from our plan, leaving us uninsured while traveling abroad. Little provisions have huge consequences.

Consider additional coverage. Remember how I said that homeowner’s insurance isn’t just one big blanket? You might need to purchase some tinier blankets, too.

Additional policies. Even if your homeowner’s policy covers, say, fire, it might not provide enough of what you want, depending on whether you live in an area prone to certain weather-related risks. You’ve read the headlines about fire insurers exiting the state of California; well, the same is true across the country for flood insurance when you live in “flood zones.” Now, these standalone policies are more difficult to access and more expensive to purchase. But depending on where you live, your financial means, and whether the property is your primary residence, consider how much you are willing to pay to offset the risk of these specific losses. I know. This sucks.

Scheduled personal property. Your standard homeowner’s policy might not pay you the full replacement cost for your high-value personal belongings. For an additional amount, you can purchase a “rider” or “endorsement” specifically naming those items. We’ve got coverage for our wedding rings and watches but stopped short of anything else, because to us, replacing most of those items immediately just isn’t worth the cost of insuring them. It’s a cost-benefit, at the end of the day.

Know your home and its contents.

Renovations, additions, and market fluctuations. Have you made any major improvements to your home? Is your home worth like, three times more than before the pandemic? You want to be sure that your insurance covers the current value of your property—even if that means your premiums increase.

Ledger of furnishings, etc. From a risk management standpoint, some would say it’s prudent to keep a running ledger of the furnishings and personal property inside your home. I’m not going to tell you we’ve done this—we haven’t. But I think, in the inland suburbs of New Jersey, our preparedness has been proportional to the risks we face. However, I found this fillable Home Inventory Guide on the California Department of Insurance website pretty helpful. The National Association of Insurance Commissioners also has a Home Inventory App that allows you to take and catalogue photos of items in your home. I’m sure there are more options like this out there, if you’re feeling up for the task.

Keep policy information handy. At the very least, keep: (a) the names of your insurance carriers; (b) their claims contact information; and (c) your policy numbers in an accessible place, like a Google doc or a starred email. Should a crisis arise, you’ll want to be able to take your initial steps without going on a scavenger hunt.

DURING

Record before you leave. This builds upon taking inventory of your belongings. Maybe you never did that. Maybe your inventory’s out-of-date. Maybe you just want to remember how you had things, or you want to be able to articulate your style down the line, or you just want to remember…there’s many reasons that go far beyond cataloguing for insurance purposes. If you’re faced with an imminent evacuation, use your phones and take the time to record every room in your home. You won’t regret it. Don’t forget your garage.

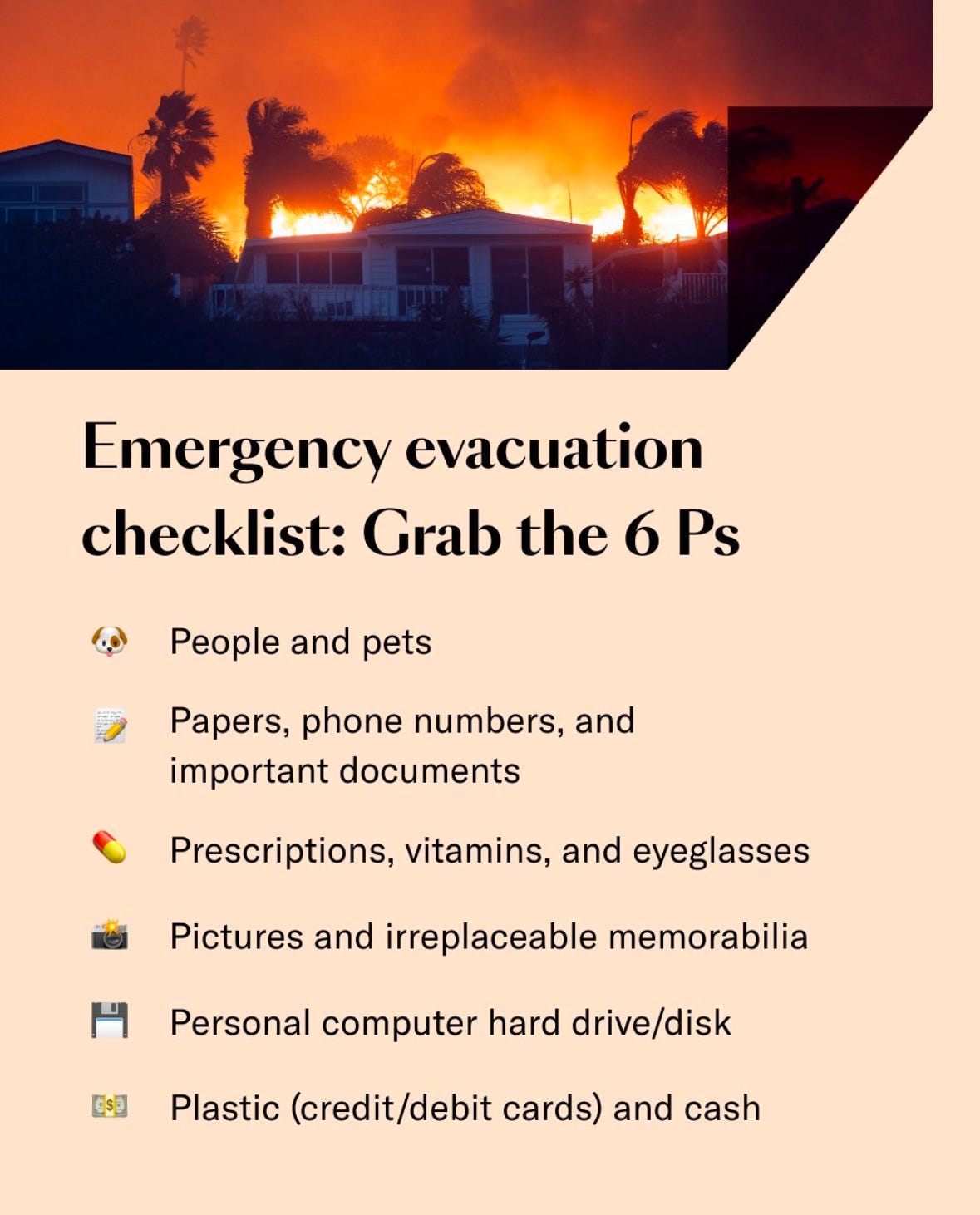

Bring the important stuff. I’m not a survival expert and won’t attempt to create an exhaustive list of everything you should bring when leaving home. There are too many variables: how big your car is, how much time you have, whether you have kids or pets to bring with you. Though, I like this simple infographic from my friends at The Skimm’:

It’s not my place to say what items you “can replace,” what should come along, and what you’ll wish you still had. I was very moved by what John Mayer shared on Instagram about mementoes. I’ve had the black lace doily from my grandma’s funeral in the purse I carried that day, and I can’t bring myself to remove it from the purse. Our hearts can assign unreasonable value to things. Do your best to bring those things. You will have more feelings to work through if you can’t.

AFTER

Move fast. Not with big decisions but to file your claims and provide what your insurer needs, especially in a crisis impacting thousands of people. Think about the fires: right now, entire claims departments of insurance companies are trying to come up with their game plans for responding to the barrage of new claims flooding through their doors. They probably don’t even have the staffing in place for an event of this magnitude. Be early. It’s your best shot to avoid getting swept up in outsourcing, confusion, or bulk decision making that could result in less personalized and favorable outcomes for you.

Keep receipts. Document every single expense from hotels and short-term rentals, to food, to gas, toiletries, clothing, etc. The ALE provision in your insurance policy may require proof for reimbursement; and even if it doesn’t, there could be other opportunities for relief that require it. Have a strategy to stay organized—maybe take a photo of every receipt so your phone can automatically catalogue by date. Whatever works best for you.

Don’t abuse your claims adjuster. So, don’t cancel me for this one. I know you might be emotionally broken. They might be detached and overworked. But I can assure you, there is zero benefit in making an enemy of your claims adjuster from the jump. Know their name. Ask questions. They are still people—people who often have the authority to recommend and give you what you want. Even when you disagree, you can be forceful without being hysterical. There is a difference, which brings me to my next point.

Negotiate everything. You should not feel like your insurance company’s first offer is the last word. Negotiate, negotiate, negotiate. Bring facts. Bring receipts! Bring estimates from multiple contractors. Treat your claim as a professional dispute to be settled; not an edict thrust upon you that you have no control over.

Be wary of “swoopers.” Sadly, when you’re in a disaster zone, people show up to make money off your pain and suffering. Some of them perform services that you really need, which sucks. I know I’m speaking out of both sides of my mouth when I say, “move fast!” and also, “be careful!” but you do need to hold anyone you hire to at least the minimum standard you would in a less catastrophic situation. I am talking about anyone from mold remediation companies to builders to public adjusters. Verify their licensing; check your state’s consumer protection bureaus for any complaints against them; try starting local with personal referrals; and always be sure you understand how they get paid.

Pause before hiring a public adjuster. Public adjusters are independent contractors who you hire to evaluate and negotiate a claim on your behalf with your insurance company. I get the draw: the process is overwhelming, and they’re there, “ready to help.” However, they also take a cut of your final check. The wonderful lawyer moms in one of my online groups pose a great point: following disasters like the Los Angeles fires, you should wait and see what the state and federal governments are going to do. Sometimes, you see regulations that compel insurers to pay out their limits. Other times, you can accomplish your goals on your own with some healthy negotiation. Just don’t rush into bed with someone eager to take a portion of the money you may not need to give them.

Stay informed. State and federal programs and assistance will arise on a rolling basis. Stay on top of them not just in the weeks following a disaster but for months and years to come. My dad reminded me how the government subsidized raising up thousands of homes in flood zones down the Jersey Shore in the years following Hurricane Sandy. I know it feels better to turn off, but you just have to stay informed to get what’s yours.

Thank you to everyone who stuck with me here. If you think this week’s newsletter will help anyone you know, please pass it along. If you have more to add, feel free to email us.

Douglas and I send our sincerest sympathies to those whose lives have been upended, challenged, damaged, and lost.

A helpful resource

Because of how much time this week’s post took to prepare, I did not have a chance to adequately vet donation opportunities to help those impacted by the Los Angeles fires. We are VERY careful where we send people these days. I’ve personally chosen to Venmo a few trusted friends who have literal boots on the ground and are working with local initiatives directly.

However, my friend and financial behavior specialist Ashley Quamme is allowing me to share with you this whole list of therapists and providers who are offering FREE short-term mental health therapy to those in need. What an amazing resource. Thank you, Ashley.

TJA in the news

CNBC had Douglas on the line this week:

On how to handle large concentrated positions in your portfolio.

On how much you could save by opting into Dry January (lol).

On how much bitcoin (if any) should be in someone’s portfolio.

On the difficulties of picking stocks, even with a ton of info.

Are you a brand or business interested in reaching The Joint Account’s 13K+ subscribers?

Would your organization benefit from having us talk about love and money?

We’d love to hear from you!

Find us on social: @dougboneparth + @averagejoelle :)

The content shared in The Joint Account does not constitute financial, legal, or any other professional advice. Readers should consult with their respective professionals for specific advice tailored to their situation.

Such valuable information bravo!