Q&A: My husband thinks we should buy bitcoin. I'm open to it, but where do we start?

A new reader question on The Joint Account.

QUESTION:

All my husband talks about is crypto. He thinks we should buy bitcoin. I’m open to learning, but I really don’t get it at this point. How and where can we even start?

ANSWER:

For those who don’t know, Heather and I have been bitcoin holders for more than a decade. I’ll spare you the long version of the story, but in 2014, one of my childhood friends convinced us to split the cost of a fancy computer capable of “mining” bitcoin. At the time, we knew very little about bitcoin or the blockchain technology behind it, but we were young, curious, and had a sizable appetite for risk. Also, my friend is a bit of a savant, so after he educated us on the basics, we figured he might be onto something.

So far, it seems like he’s been right. Bitcoin’s wild ride from its inception through today’s all-time highs is one for the history books. In my 20-plus years of working in wealth management, it’s not every day you get to witness a new asset class become worth $1.7 trillion. It’s incredible stuff, especially to finance nerds like me. But does that mean everyone should be piling into bitcoin? The answer is most certainly, no. What’s right for us is not what’s necessarily right for you or anyone else.

In my personal and professional life, I’ve made a habit of encouraging everyone to learn more about bitcoin and, in a broader sense, blockchain technology. People tend to take uninformed positions on things they don’t understand rather than doing their own research and drawing their own conclusions. There’s no cost or risk to educating yourself. The best place to start learning about bitcoin is the original bitcoin whitepaper. Although it’s a bit technical, it’s not long and is widely considered mandatory reading for anyone interested in understanding bitcoin. But if that freaks you out, there’s no shortage of quality guides, like this one from Coinbase, the world’s largest crypto exchange.

Whatever you do, don’t just take your husband’s word for it or buy into the hype just because the price of bitcoin is up. As with any investment, you should both understand the basics and be on the same page before making any decisions.

If you’re still interested in learning more, try dipping your toes in the water. I’ve always been a fan of learning by doing, because it’s the best way to remove any first-time jitters. Most people waking planet Earth haven’t had the experience of using a digital wallet or trusting a trustless system. You’re not expected to know what any of this looks or feels like until you actually do it yourself. Consider taking a nominal amount of money, let’s say $5, and buy some bitcoin with it. Putting knowledge into practice is how you gain confidence.

If you’re totally overwhelmed by the process of using a digital wallet, there’s now a way to participate in bitcoin while still using traditional financial products. Earlier this year, the SEC approved the first spot bitcoin ETFs (which stands for, exchange traded fund). Through these funds, you can indirectly own bitcoin in most of your major brokerage accounts. Truly, this is not the full “decentralized” experience of exchanging cryptocurrency; however, you’ll still get to feel what the price movements of bitcoin are like.

If you and your partner sat down and considered all of this, you should be in a good position to meaningfully consider incorporating bitcoin into your overall investment strategy. Now, I can’t tell you how much to invest, or if investing in bitcoin is right for you guys at all. Bitcoin is a risk-on investment—only you know what your true appetite for that is. But I can share with you that most financial advisors who are open to the idea of bitcoin think between 1 and 5 percent of your portfolio might be appropriate. Of course, enthusiasts will say that’s not enough, and skeptics will say it’s too much! Again, only you know the answer here.

In personal finance, there will always be opportunities that spark curiosity and conversation—bitcoin is undoubtedly one of them. The key takeaway here is not to let emotions or FOMO drive your decisions. Instead, embrace the chance to learn, experiment, and engage in thoughtful discussions with your partner about what makes sense for both of you. You might actually have fun with it, too.

Have you dabbled in crypto, or does the thought make you break out in hives? Let us know!

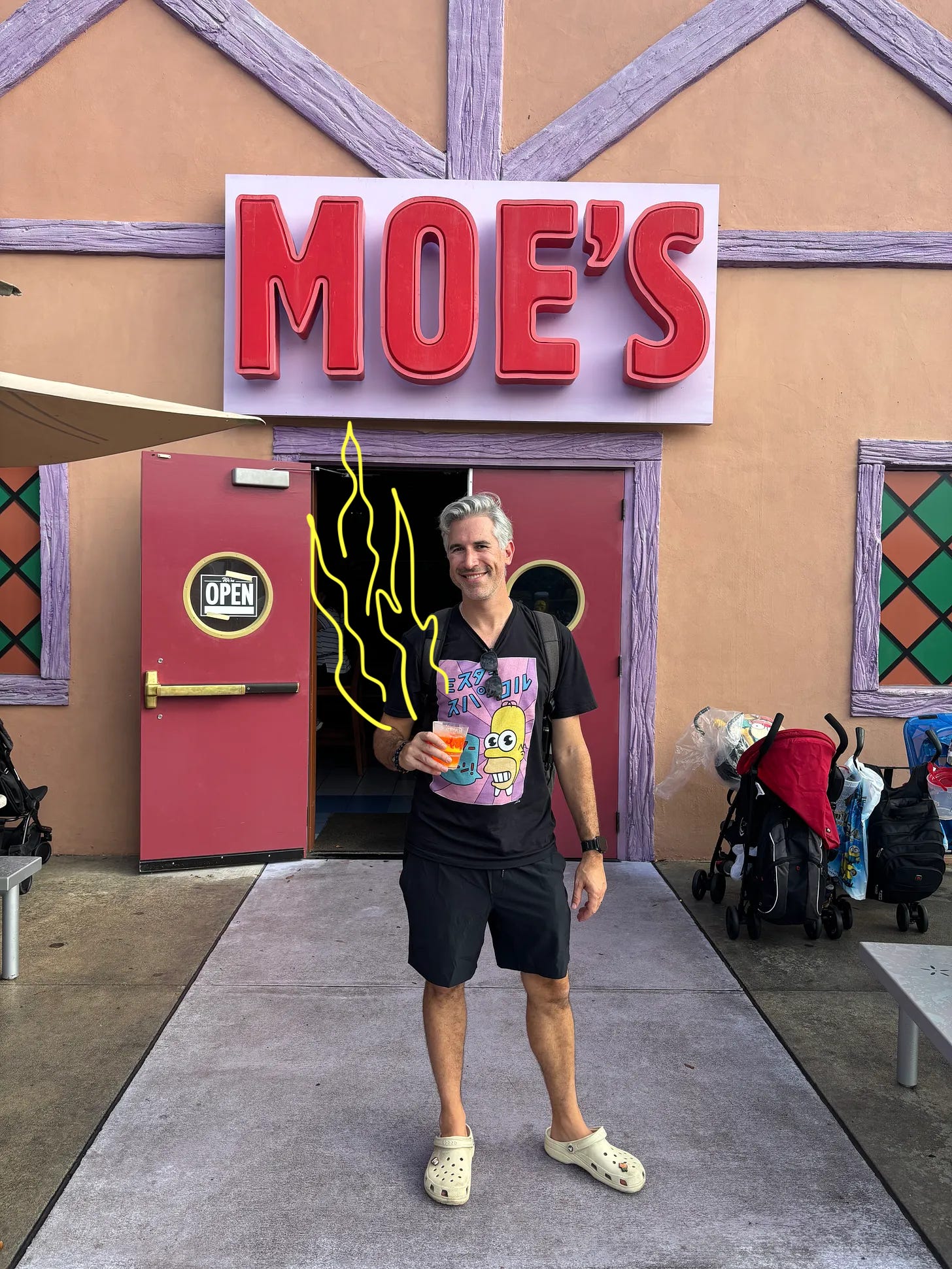

Every November in New Jersey, there’s something called the Teacher’s Convention. It’s unclear to me whether there’s an actual convention taking place. All I know is that the kids are off from school. Anywho, we flew down to Orlando to check out Universal Studios for some family fun, and this diehard Simpsons fan finally got to visit Springfield! That’s me with my Flaming Moe.

TJA in the News

Heather wrote her first essay for SheKnows on one of the trickiest care gaps that working families face: the hours after school.

She also had an AWESOME interview with Pauline for the Money Feelings newsletter, right here on Substack.

And I spoke with Fortune on why 35 might be the hardest age.

Are you a brand or business interested in reaching The Joint Account’s 13K+ subscribers?

Would your organization benefit from having us talk about love and money?

We’d love to hear from you!

Find us on social: @dougboneparth + @averagejoelle :)

The content shared in The Joint Account does not constitute financial, legal, or any other professional advice. Readers should consult with their respective professionals for specific advice tailored to their situation.