Q&A: How do I get my super-saver spouse to invest?

Mutual goals are the gateway to a new outlook.

Welcome to the second issue of The Joint Account. This week, Doug’s addressing a fundamental issue that couples struggle with. Let’s figure out how to noodle your way into a tough conversation and maybe even slide a chart across the table…maybe.

QUESTION: I think we should be investing more of our money, but my husband loves holding cash–maybe too much cash. How do I get my super-saving spouse to consider investing?

ANSWER:

For most people, cash feels like a weighted blanket. There’s comfort in knowing its value won’t fluctuate while it collects interest in a bank account, accessible at any time. But if otherwise appropriate, your partner’s refusal to invest shows that he views your money more as security and not as an opportunity.

It’s not easy to convince your partner to assume more risk after he’s used to a certain level of security. For one, cash looks good. Interest rates are attractive. And recent market history doesn’t provide much comfort. The Great Recession and pandemic were bookends to an “unprecedented” economy, leaving people to look over their shoulders and worry about the next black swan event. We lived through an economic whipsaw and still haven’t found our equilibrium. Cash isn’t just security–it’s an opt-out from the drama.

When your partner is more risk averse than you, make sure to hear them. First and foremost, they do need to know that you understand and respect their reasons for feeling the way they do. Sharing feelings leads to trust leads to compromise. This is a theme we’ll continue coming back to as long as we’re here together.

For my clients, I do suggest the average couple holds six to nine months of their living expenses in cash; sometimes more, depending on their individual motivations and circumstances. But beyond that, sitting on too much cash blinds you from chances to grow your wealth.

Use your long-term goals as a gateway to your conversation, because they probably require greater returns than you’ll earn in cash. Do you both dream of owning a vacation condo someday? Cool. Start with a goal you’re most aligned on to engage your partner and show him that this isn’t a request you’re shooting from the hip on, but rather, a requirement needed to even come close to what you both want to accomplish later on.

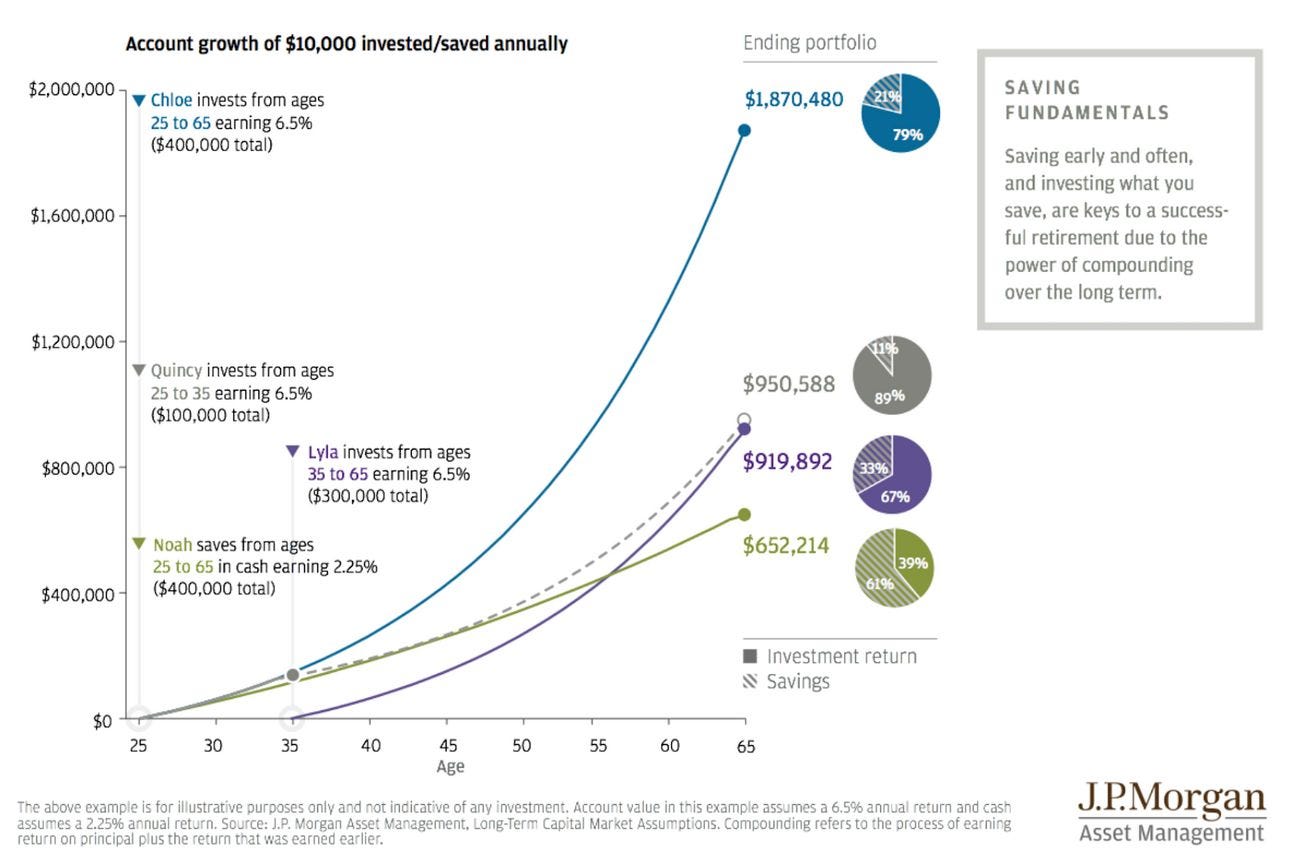

Data helps drive it home. The chart below speaks volumes about the importance of investing.

Pairing one of your jointly held long-term goals with actual data makes the prospect of investing less conceptual and more concrete. It’s much harder to ignore the possibilities when they’re personal.

Compromise matters most, as with almost anything in a committed relationship. Maybe the answer comes in holding onto a year’s worth of cash (double my typical suggestion) and investing the rest. Maybe your spouse is open to incremental, monthly investing in a more conservative portfolio.

Any progress is progress. People don’t change overnight, and you shouldn't expect them to.

But that doesn’t mean you can’t do better, just like your cash.

Send us your couples-n-money questions for the next Q&A: themergebook@gmail.com.

In Q&A weeks, we’ll also share some links to what we’ve been reading. Expect more finance-focused articles from Doug, and from Heather, well…whatever she wants.

Doug’s Picks:

How Nvidia Built a Competitive Moat Around A.I. Chips - New York Times

Why A Stranger's Hello Can Do More Than Just Brighten Your Day - NPR

Heather’s Picks:

Why Are Forty-Something Women Obsessed With The Summer I Turned Pretty? - Vogue

The Deep End – Finding Joy

A Cheat Sheet for the Tennis Curious – The Cut

We want to hear from you!

Do you have a money question you’d like answered in a future issue? Nothing is too icky. Let’s go there.

AND…a source call for the book: How does your origin influence your relationship with money? Origin = geographic location, religious or cultural background, socioeconomic history, etc. This is a super important topic and one we’re trying to tackle from many angles.

Please email themergebook@gmail.com and help us out, if you’re willing! Thank you so much!

Are you a brand or business interested in reaching The Joint Account’s audience of 11,000+ subscribers? Email themergebook@gmail.com.

Find us on social: @dougboneparth + @averagejoelle :)

The content shared in The Joint Account does not constitute financial, legal, or any other professional advice. Readers should consult with their respective professionals for specific advice tailored to their situation.